Whether you’re reading this on the blog or watching on YouTube — welcome. This is my monthly check-in on the road to FI: 11 years and 13 days left, and I’m 18.21% of the way there. I track this to stay honest with myself. Because if you don’t measure it, how do you know you’re moving? There’s a chance I’ll reach financial independence sooner than planned — and I’ll explain why. So stick around till the end, because I’ll share the actual numbers behind my sub-trajectory: the calculations, assumptions, and what they mean for my timeline. I hope this will inspire you to track your journey too!

Highlights

Life isn’t just about money. I try not to lose sight of that — and to live fully, not just efficiently. Here’s what stood out for me this month, beyond the spreadsheets:

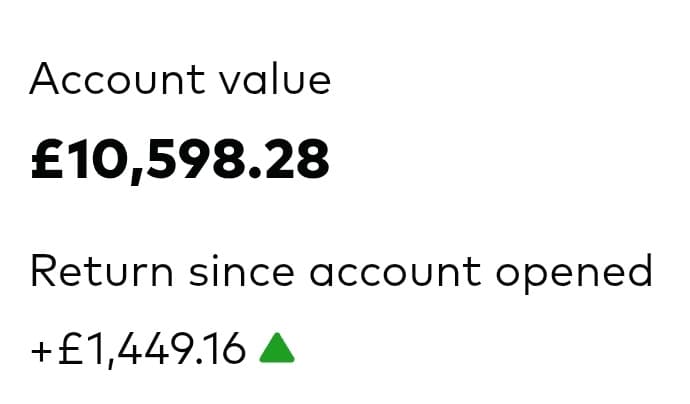

- £10k!!! In my ISA!!! What a milestone! I’ve finally crossed the £10k mark in my ISA. It took a little over two years, but I’m really proud of this achievement.

- I’ve increased my regular ISA contribution by £50 to speed up my progress toward financial freedom.

- I negotiated one hour less of work without a pay cut. Every Friday that extra hour lets me walk my children to school — a small step, but my first taste of financial independence.

- We went on a family trip to Saltdean and then walked all the way to Rottingdean for some ice cream. A simple day out, but definitely one of the highlights of the month!

- This month I had some health issues that really gave me a wake-up call. It made me stop and look at life from a slightly different perspective, and I feel like I’m approaching things with a new mindset now.

- Whenever I can, I bike to work to stay healthy and save money. This month I managed to save £10 on commuting, and I deposited it straight into my Trading 212 account as a little extra motivation.

- We visited Amberley Museum – a whole day dedicated to exploring vintage buses and their history.

My Portfolio – £1k quest

Quick disclaimer: I’m not a financial advisor. This is just my personal journey and what’s working (or not) for me. Always do your own research and speak to a qualified professional before making financial decisions.

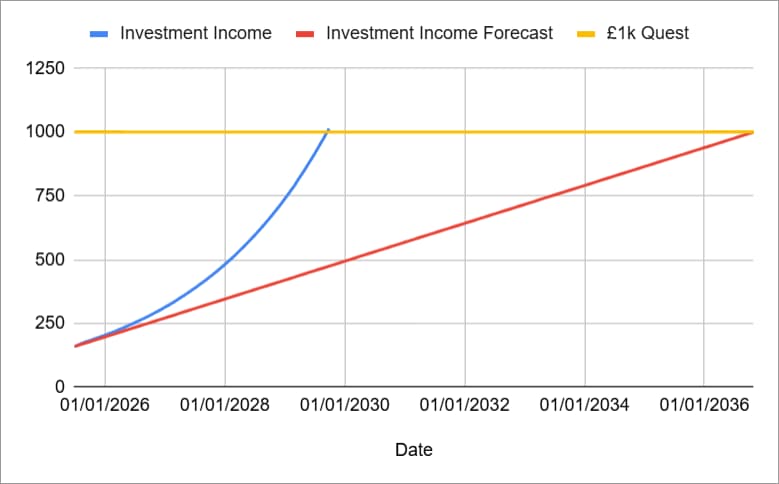

What’s the £1k Quest? My goal is to reach financial independence — which, for me, means generating £1,000 a month in passive income by the age of 57, when I’ll gain access to my workplace pension. That’s roughly the amount of the UK state pension, and I call this target the £1k Quest. It might sound modest, but it doesn’t mean I’ll stop working or investing once I hit it. And remember — when I do retire, the state pension will come on top of that. This is about building a solid, flexible base. The rest is optional upside.

By following the 4% rule, withdrawing 4% annually from a £300,000 portfolio would give around £1,000 per month in passive income. This gives me a clear target to work toward.

So let me show you where I’m at — and what’s under the hood.

I plan to accumulate this sum from three main sources, and this is what I have in each of them:

Workplace Pension – £43847.45

ISA – Stock And Shares (Regular Monthly Contributions) – £10276.73

- FTSE Global All Cap Index Fund – £7261.72

- FTSE All-World High Dividend Yield UCITS ETF – (VHYG) – £195.66

- Sterling Short-Term Money Market Fund – £2757.23

- Cash (uninvested) – £62.12

ISA – Stock And Shares (Pocket Money Contributions) – £514.5

- Main Street Capital (MAIN) – £204.05

- JPMorgan US Equity Premium Income ETF (JEPI) – £177.46

- Realty Income (O) – £76.40

- Tesla (TSLA) – £5.12

- Vanguard FTSE All-World High Dividend Yield ETF (VHYL) – £50.74

Dividends

This month, my investments started generating some passive income:

- Main Street Capital (MAIN) – paid me £0.75

Progress So far

This chart shows when my portfolio is theoretically expected to generate £1,000 per month, represented by the yellow line. The red line illustrates the planned path to reaching my goal by the time I turn 57, which will be in October 2036. The blue line represents a statistical projection based on the percentage growth from the period for which I have real data, indicating that I could reach my goal as early as October 2029. This will certainly be adjusted over time and will likely align more closely with the red line. I hope it will turn out to be more parabolic and reach the target earlier 🙂 It’s important to remember that the portfolio will only be able to generate the projected £1,000 once I gain access to my workplace pension, which will become available at the age of 57!

Summary

The total across all three of my sources stands at £54,638.69. If I had access to my workplace pension today, applying the 4% rule would allow me to withdraw £182.13 per month. It’s a modest but steady stream that highlights the importance of long-term planning and diversified savings.