- What is a Dividend Income Stream?

- Where Did I Learn About It?

- How Does It Compare to the S&P500 and All-World ETFs?

What is a Dividend Income Stream?

A dividend income stream is a regular flow of cash from dividends, meaning money paid to investors by companies for owning their shares. Simply put:

- 👉 You buy shares of a company

- 👉 The company makes money

- 👉 A portion of the profit is paid to you as a dividend

- 👉 This creates a regular cash flow

How Did I Learn About It?

I first learned about this way of thinking from the book “The Income Factory” by Steven Bavaria.

Steven compares investing to Henry Ford’s factory:

- The factory produces cars

- Money from selling cars is like dividends

- These dividends can be reinvested so the “factory” grows and produces even more

For me, investing in dividends is like building a well, from which water slowly drips – money that I can use for new investments or to improve existing sources of income.

Remember: I am not a financial advisor. I’m just sharing my journey toward financial freedom. Everything I talk about should be treated as an example of my own experience, not as investment advice.

My Vision

I want to build an entire farm of wells, from which money will slowly drip. These funds I can:

- reinvest in new wells

- improve existing ones

More and more people online are sharing their experiences with investing in dividend-paying instruments. A social movement around the philosophy of The Income Factory seems to be emerging.

Personally, I’m fascinated by the idea of receiving passive income from such investments.

My current position

I bought my first “wells” – dividend-paying companies.

My selection criteria were:

- stable and reputable businesses with a long history

- companies whose products I personally use

- an average dividend of around 4% per year

- ideally, growth-oriented companies

My “farm of wells” already has its first sources – now I just need to watch the money start to drip.

At the beginning of March, I will share with you how much my wells have produced.

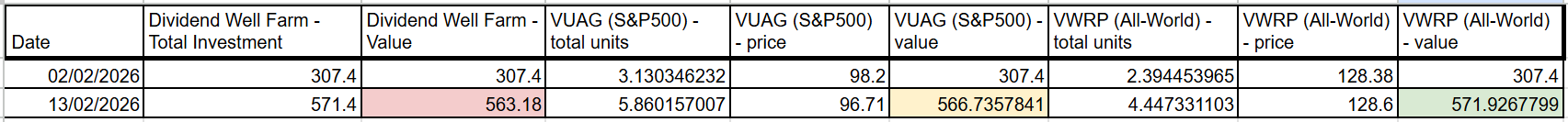

For now, I can share how my farm of wells compares to two products: Vanguard VUAG (S&P500) and VWRP (FTSE All-World UCITS ETF).

To be clear – I am not sponsored by Vanguard, and the fact that I reference their ETFs is purely coincidental.

If you want to follow the progress of my “farm of wells” and see how my Dividend Income Stream grows, please subscribe to the channel and leave a comment – I’d love to hear about your experiences too!